Review By APK-Free

✨ Awareness Points: Recognizing the Present Need for Tax-Free Shopping ✨

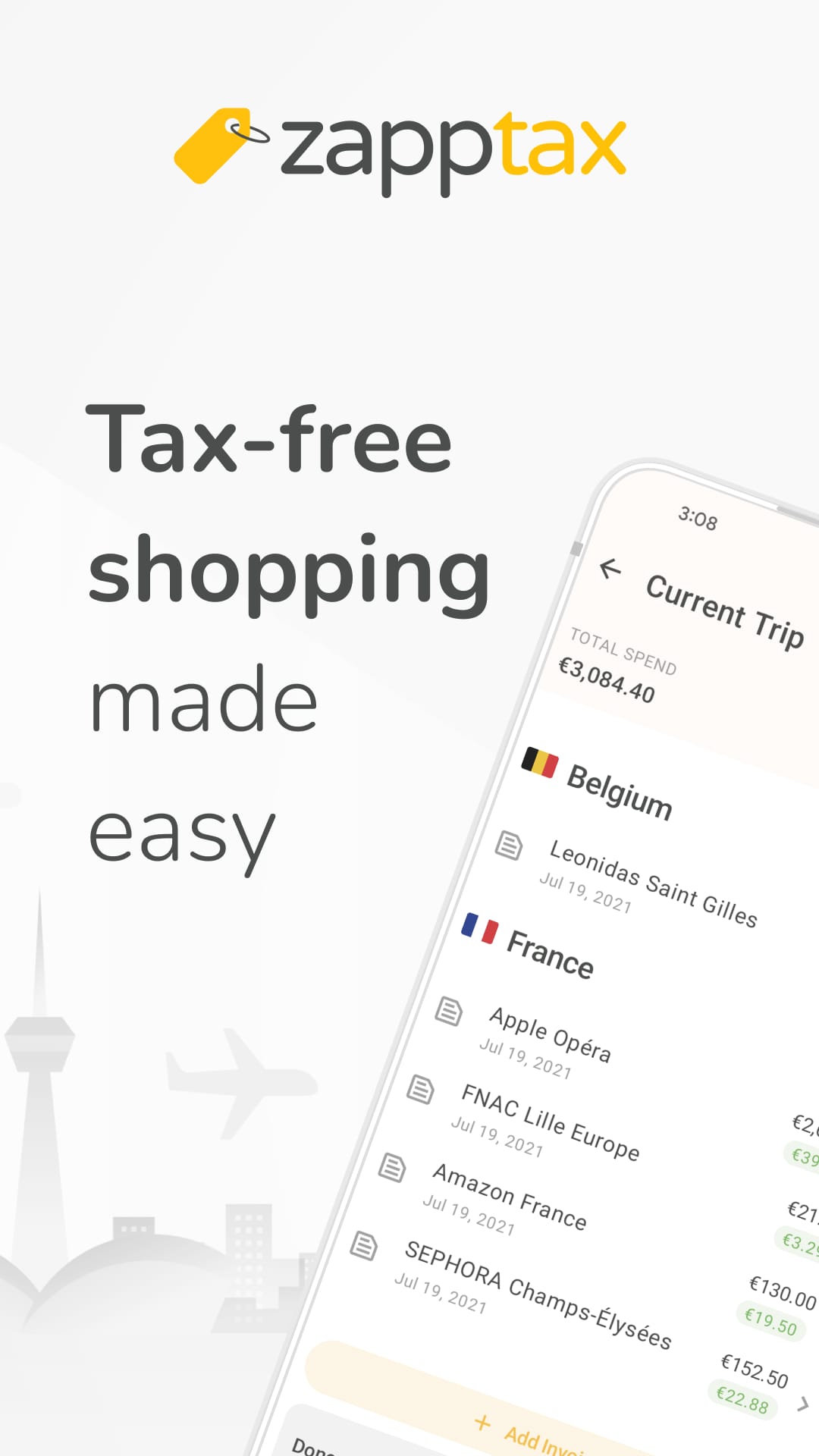

Traveling internationally often presents opportunities for shopping, and this application aims to simplify the process of claiming VAT refunds. The initial awareness point is recognizing the potential savings available through tax-free shopping and the complexities involved in navigating traditional refund processes.

Simplified Refund Process

The app streamlines the tax refund process, potentially reducing stress and confusion for travelers. This simplification encourages users to be more present and engaged with their travel experience, rather than burdened by administrative tasks.

🌿 Present Moments: Cultivating Focus on the Shopping Journey 🌿

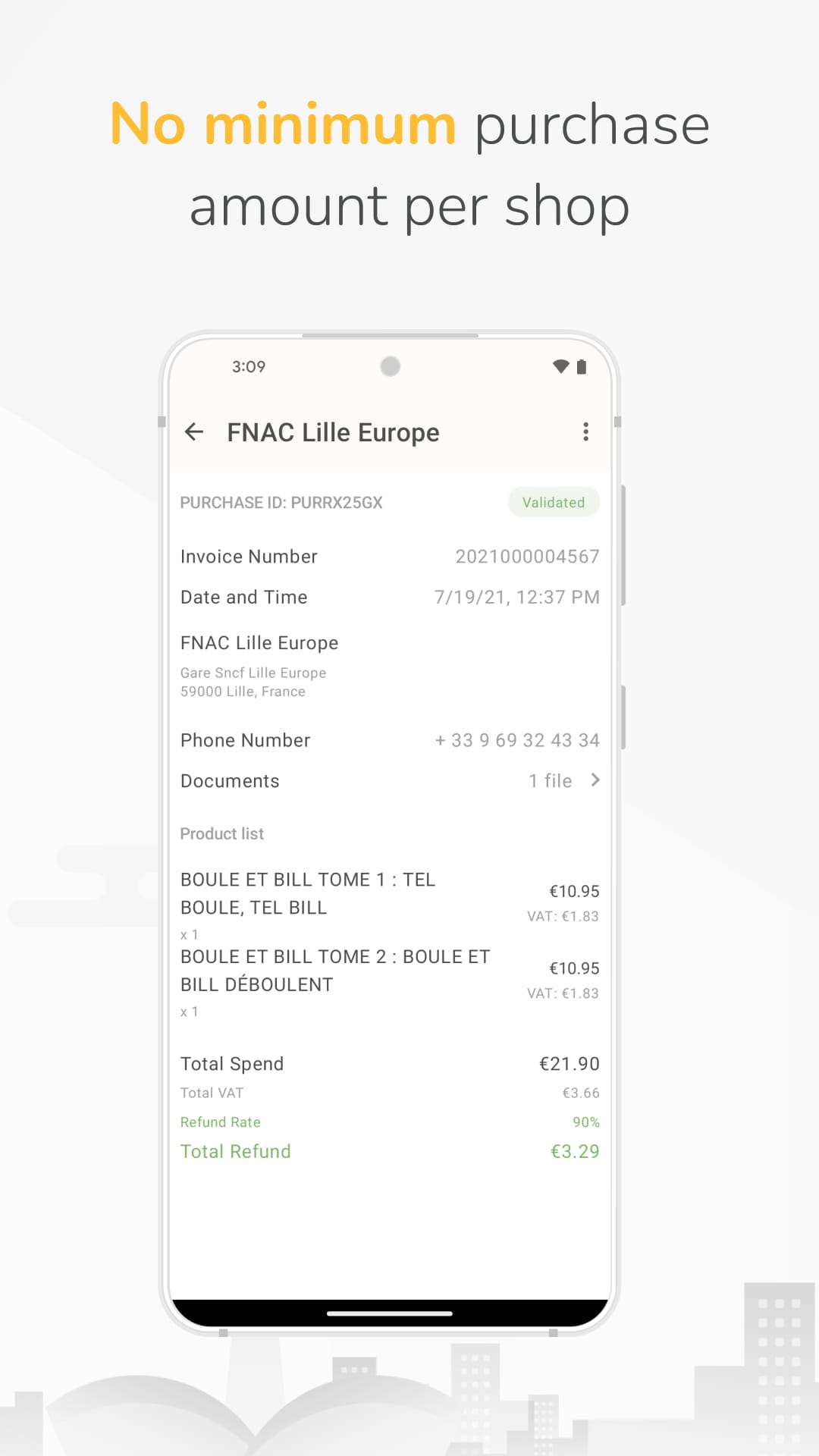

Instead of focusing on the daunting refund process *after* the trip, the app encourages mindful attention to each purchase made during the journey. This involves being present when selecting items, understanding the VAT implications, and documenting each transaction efficiently.

- Mindful Shopping: Encourages users to be present during purchases.

- Efficient Documentation: Streamlines receipt management.

✨ Conscious Features: Designed for Intentional Use ✨

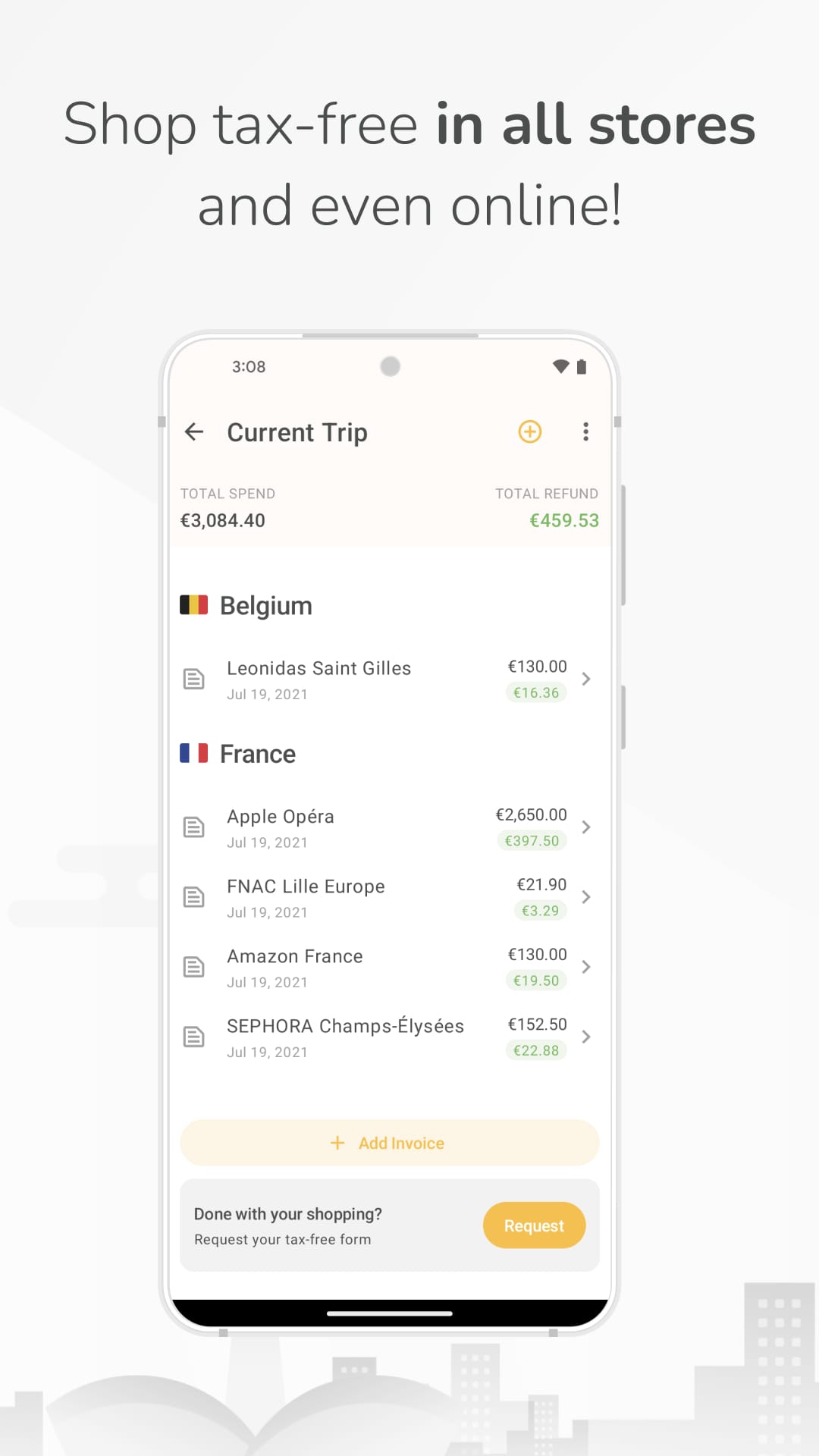

The app’s features are designed to promote intentional use, prompting users to consciously track their spending and understand the benefits of each purchase. This includes features for receipt scanning, VAT calculation, and refund tracking.

Advantages

- Easy receipt scanning.

- VAT calculation.

- Refund tracking.

Disadvantages

- Potential for over-reliance on technology.

- Possible data privacy concerns.

🌿 Mindful Aspects: Fostering Aware Interactions with Financial Benefits 🌿

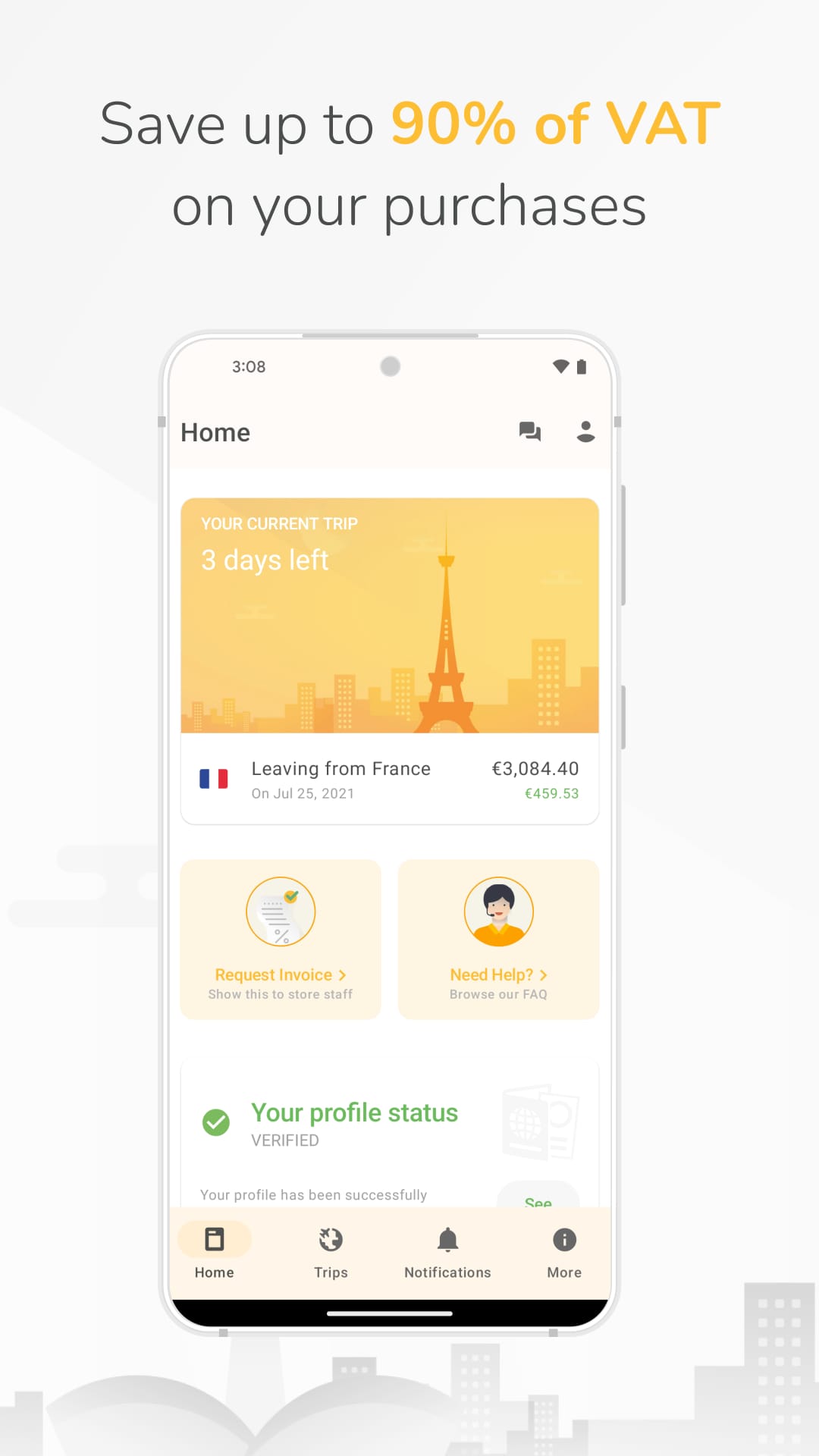

By providing a clear overview of potential VAT refunds, the app encourages users to be more aware of their financial transactions while traveling. This awareness can lead to more informed purchasing decisions and a greater appreciation for the value received.

Financial Awareness

The app highlights potential savings, promoting financial mindfulness.

✨ Intentional Design: Balancing Convenience with Conscious Spending ✨

The app’s design should aim to strike a balance between providing convenient solutions and fostering conscious spending habits. Over-automation could lead to mindless purchasing; therefore, intentional design choices should encourage users to remain engaged and aware of their financial decisions.

| Design Element |

Mindful Consideration |

| Notification Frequency |

Avoid excessive reminders to prevent desensitization. |

| Information Clarity |

Ensure information is presented concisely and understandably. |

Overall Mindful Value

The app offers value by streamlining the VAT refund process, provided users remain mindful of their spending and privacy considerations.

Description

ZappTax is a digital tax refund application that has been approved by the tax authorities in France, Belgium, and Spain. Since its establishment in , it has gained the trust of over , users who rely on ZappTax to obtain their VAT refunds for purchases made in these countries. One of the key advantages of using ZappTax is its reliability, as it is the first digital tax-refund operator to be approved by the tax and customs authorities. Additionally, ZappTax can be used for tax-free shopping at any shop in France, Belgium, and Spain, whether it is an in-store or online purchase. There are no restrictions on the minimum purchase per store and per day, providing users with peace of mind while shopping. The process is also made easy through the app, as it offers a % digital procedure that eliminates the need for messy paperwork. Users can generate tax refund forms and obtain customs validation directly on their smartphones. ZappTax also offers great value, providing users with their money at the best rates in the business and allowing them to choose their preferred refund method, such as bank transfer, credit card, or PayPal. Additionally, ZappTax provides excellent customer service with / messaging and phone support to address any questions or problems that users may have. Using ZappTax is a simple process that can be completed in a few easy steps. First, users need to download the app for free and complete their profile. Then, they need to fill in the dates of their stay in the European Union. When shopping, users should ask the merchant for a "VAT invoice made out to ZappTax" and photograph their invoices. These invoices can then be uploaded to the app or forwarded by email to [email protected]. At the end of their stay, users can request the automatic generation of their tax-free forms through the app. These forms will show all of their purchases. To validate the tax refund forms, users can either scan the forms' barcode at a self-service kiosk (PABLO device in France and DIVA in Spain) or present their passport to a customs agent in Belgium. Once the forms are validated, ZappTax will process the refund and pay the user using their preferred method. In summary, ZappTax is a trusted digital tax refund application that has been approved by the tax authorities in France, Belgium, and Spain. It offers several advantages, including reliability, usability at any shop in these countries, no restrictions on minimum purchases, an easy % digital procedure, great value with competitive rates, and excellent customer service. The process of using ZappTax is simple and involves downloading the app, completing a profile, photographing invoices, generating tax refund forms, and validating them at customs. ZappTax will then process the refund and pay the user using their preferred method.